Chief Financial Officer (CFO) basically looks at the finance matters which is life blood of your organisation and provides strategic inputs that facilitate smooth operation of business.

As a business owner you have already experienced the uncertainties of running a business, which undergoes cyclical change in customer demand, challenges in hiring and retaining of talent, pricing pressure due to competition, strategic expansion decisions, borrowings and repayment pressures. These challenges distract you from focusing on business growth and results in slow down.

Having a CFO can release this relentless pressure as he/ she can take up following roles:

Setting Targets: First step in your growth story is writing an ideal script for your business for the next 12 months. CFO will help you to design this script by making it as realistic as possible. It should be aspirational as well as achievable.

Cost Control and Reduction: Costs in operating a business if left unchecked can result on unnecessary burden. CFO can design a budget for a business and minutely track movement in each budgeted expenses thereby controlling expenses. By bringing in Systematic Accounting practices in the organisation, CFO can also look at cost reduction measures.

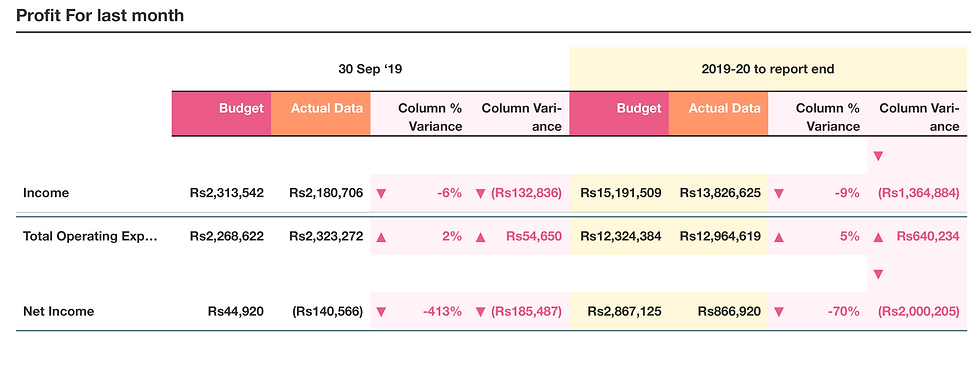

Performance Analysis: CFO can design specific management information reports from the accounting records which can help the business owner to know what's happening in his business and what are the important aspects of his business which is resulting in either a profit or a loss, CFO can even point out if a certain division is generating profits or incurring losses and track on performance of each products or services offered by the company. This performance analysis provides business owner key insights based on which he can decide if certain operations have to be expanded or discontinued.

KPI formulation for Key Executives: Designing an adequate and attractive compensation plan for the executives in the company will actually lead to retention of talented staff which will then foster growth of the organisation and build better credibility in the market. The CFO can design key performance indicators for their top executives which is in line with the objectives of the organization and based on which compensation can be structured, this helps the business owner in running the business efficiently and motivate the team.

Finance/ Capital Arrangements: As a business owner you may also require additional capital from external sources necessary to expand the business, so the CFO can help the business owner by arranging finances through banks or venture-capital.

Improve Cashflow: CFO can be involved in regular operations of the business to improve the cashflow, by devising credit control policies, introducing follow up mechanism.

Standardising Accounting process: As CFO has strong accounting skills, he can set up strong internal control systems for accounting as well as detailed procedure to record transactions. This results in better transparency and create better valuation for the business during mergers and acquisitions.

Better Business Valuation: As CFO brings in strong processes in the business, it leads to better credibility in the business. With compliances being taken care by CFO, it reduces red flags during due diligence. And when investors get good quality financial reports, it enhances value of the business.

We at CFOLead will help your business grow faster, improve efficiency through use of technology and let you unlock real value of your business. Click here to know more

Comments